Despite persistent economic worries in the 3rd quarter, US banks were finally almost fully back to 07 earnings levels. US banks earned $35.3B in the quarter compared with $35.6B in 3Q07.

On an ROE and ROA basis banks showed similar signs of healing. Even though investors continue to worry about the earnings power of banks under a new regulatory environment, returns on equity and assets continue to improve and are almost back to pre '08 levels as well.

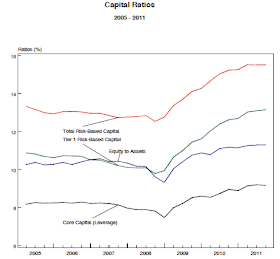

Banks are earning these profits at much higher levels of capital as well. The US banking system is extremely well capitalized. The stress tests wont show anything different.

This is especially true because credit continues to improve. Barring another recession, banking balance sheets should continue to get better. For now, they seem to have turned the corner.

No comments:

Post a Comment

For compliance reasons, I don't post comments to the site, but I do like hearing from readers and am happy to answer any questions. Feel free to use the comment box to get in touch. Please leave an email address in your comment so that I can write back, or email me directly at Skrisiloff@avondaleam.com.