Despite the significant rise in the price of gold, demand for gold has remained reasonably flat:

Gold Demand By Category

In this decade, the interest in gold has skewed more towards investment than at any time since the 1980s, when gold hit its all time inflation adjusted high. Interestingly, gold demand in the 2000s was predominately jewelry driven. The price of gold obviously rose significantly in that environment as well.

Gold Demand for Jewelry

Jewelry demand has historically been and continues to be driven by East Asian countries. India and China dwarf the rest of the world in terms of demand for gold for jewelry purposes. Of course, China and India also have the largest populations in the world, so perhaps this isn't too surprising. Still consumption of gold on a gdp/capita adjusted basis likely shows a similar picture. In other words, Chinese and Indian consumers spend a larger portion of income on gold than any other countries.

Gold Demand for Investment

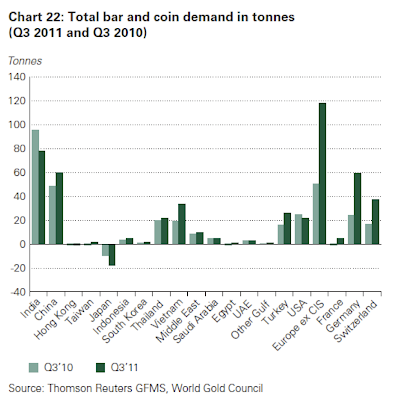

Overall investment demand rose during the third quarter. The geographical increase is striking. Europe saw a large increase in demand for gold bars and coins. No doubt this was driven by fears over the integrity of the Eurozone and the common currency. The chart below hints at the level of panic in the Eurozone.

Gold holdings in ETFs continued to increase in the 3rd Quarter. ETFs hold more than two years worth of demand for Gold.

New Gold Discovery

On a fundamental level, new gold discovery has slowed in recent years. Along with monetary policy, this no doubt provides support for the price of the metal.

No comments:

Post a Comment

For compliance reasons, I don't post comments to the site, but I do like hearing from readers and am happy to answer any questions. Feel free to use the comment box to get in touch. Please leave an email address in your comment so that I can write back, or email me directly at Skrisiloff@avondaleam.com.