By now, most people are probably familiar with a chart that looks something like the one below. It shows sovereign debt as a percent of GDP as of 2011. (All data are 2011 IMF estimates)

|

| Click to Enlarge |

The ratios are meant to give a snapshot of the solvency of each country. Like a Debt/EBITDA ratio for a company, this ratio is intended to demonstrate the amount of funds that are available to service a country's debt obligations.

The problem is though that no government has a lien on 100% of GDP, so this is not an accurate measure of the pool of funds that can be used to service debt. Governments only control a portion of GDP shown in the table below:

There is an upper limit to the amount of GDP that a government can tax. At 100% a government is theoretically enslaving its population. Anything above 50% (and perhaps even lower) begins to erode output levels as workers lose wage incentives. The optimal level of taxation relative to GDP is difficult to know, but most should agree that the lowest tax level that maintains a fully functioning government is best.

The amount of GDP that a government currently controls has important implications for its ability to balance its budget. For instance, because the US and Japan tax at low rates they could theoretically increase taxes to balance their budgets. On the other hand one could argue that taxes in a country like France are already so high that any deficit spending could only be remedied by spending cuts.

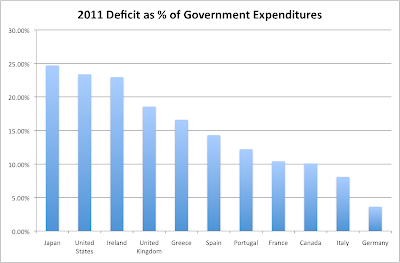

Obviously the amount of deficit spending varies from country to country though. The chart below shows each government's deficit as a percentage of total expenditures. Put another way, it's the amount of spending that is financed through borrowing.

Japan for example finances nearly 25% of its total expenditures with borrowed money. The United States finances a similar amount. Italy on the other hand finances less than 10% of its expenditures, suggesting that Italy would have to cut less than Japan or the US to achieve a balanced budget. A combination of tax increases and spending cuts could actually produce a modest surplus perhaps, calling into question the idea that Italy's debt burden is totally unsustainable.

True sustainability of debt should be based on weighing the debt burden against the cash flows that the government generates. The chart below shows governments' Debt to Revenue multiple, which is the closest metric to Debt to EBITDA that could be generated without more granular data.

|

| Click to Enlarge |

Obviously EBITDA is a smaller percentage of revenue which would increase these multiples. Like any company, governments have mandatory operating expenses before debt service. Therefore there is some EBITDA margin that can be estimated. It is probably conservative to estimate that at least 50% of revenues are for "fixed cost" operating expenses. The residual pool is what is truly available for debt service. Using this assumption, the leverage turns for each of these governments would be doubled. This means that Japan has an estimated 15x Debt/EBITDA ratio, Greece 8x, etc...

A company generally would be considered investment grade at about 3x leverage on a Debt to EBITDA basis. That company would likely be rated BBB and trading at an average spread of about 275 bps as of yesterday's close. 15x leverage is certainly at high yield levels.

On an "estimated" debt/EBITDA basis, not a single one of these countries is below 3x leverage, not even the so called healthy European countries: Germany and France. Importantly, Japan is significantly worse than Greece, and the US is more levered than Ireland, Italy and Portugal. And yet Japan, the US, Germany and France all issue debt that trades with no spread to a risk free rate of return and trade at a significant discount to inflation. Surely this is truly unsustainable.

No comments:

Post a Comment

For compliance reasons, I don't post comments to the site, but I do like hearing from readers and am happy to answer any questions. Feel free to use the comment box to get in touch. Please leave an email address in your comment so that I can write back, or email me directly at Skrisiloff@avondaleam.com.