Tuesday, February 19, 2013

RSS Subscribers

The old RSS feed for this website is no longer active. Please click the icon below to re-subscribe to the working RSS feed.

Subscribe in a reader

Subscribe in a reader

Friday, February 15, 2013

Moving on Up!

Avondale is moving! We are joining the stocktwits blog network to pair up with some of the best financial bloggers on the internet.

As a result, our blogspot address (avondaleassetmanagement.blogspot.com) will no longer be updated. Please visit us from now on at www.avondaleam.com

Tuesday, February 12, 2013

The Swiss National Bank's Currency Peg

Between the Yen and the Euro, the foreign exchange markets have seen some excitement in recent months. One currency cross that has been anything but exciting though has been that of the Euro against the Swiss Franc (EUR/CHF). After a rapid depreciation of the Euro during the heart of the European Financial Crisis, the Swiss National Bank decided to explicitly peg the Swiss Franc at 1.20 EUR/CHF. The SNB had maintained a "soft peg" up until that point by purchasing EUR in the open market, but the explicit peg was needed to stop the appreciation.

Below is a chart of the evolution of the SNB balance sheet as it has tried to stop the CHF from appreciating. The balance sheet has expanded by nearly 5x and foreign currency now represents almost 90% of the bank's assets. As a result, the CHF has effectively become backed by the Euro.

Below is a chart of the evolution of the SNB balance sheet as it has tried to stop the CHF from appreciating. The balance sheet has expanded by nearly 5x and foreign currency now represents almost 90% of the bank's assets. As a result, the CHF has effectively become backed by the Euro.

Monday, February 11, 2013

Where do Growth Stocks Peak?

Over the course of the recent bull market there have been a few growth stocks that have hit extreme levels only to come crashing down. Although some of these have recovered slightly, those that come to mind include: NFLX, GMCR, OPEN, MNST and CMG.

As a post-mortem on these stocks, below is a chart of the price to sales multiples that they hit at their highest levels. For comparison I included the peak price to sales multiples of five stocks that had similar sentiment (judged subjectively) at the 07 peak and five from the dot com era. Also included are the current multiples of six growth stocks that haven't slowed since 2009.

Total Fiscal and Monetary Stimulus Since 2008

As many are hopeful that we are finally leaving the financial crisis behind, sometime in the not too distant future the government is going to have to start unwinding the major stimulus that it has provided to the economy through fiscal deficits and monetary expansion since the crisis began.

Below is a cumulative tally of how much stimulus has come from the Fed and Treasury over the last four years. The total is now about $7T ($5T worth of deficits plus another $2T worth of monetary expansion). Amazingly, to the extent that one believes that the crisis was primarily housing market related, the $7T total represents ~70% of all the mortgage debt outstanding in 2008.

Below is a cumulative tally of how much stimulus has come from the Fed and Treasury over the last four years. The total is now about $7T ($5T worth of deficits plus another $2T worth of monetary expansion). Amazingly, to the extent that one believes that the crisis was primarily housing market related, the $7T total represents ~70% of all the mortgage debt outstanding in 2008.

|

| Cumulative deficit plus change in size of Fed balance sheet since 9/2008 |

Friday, February 8, 2013

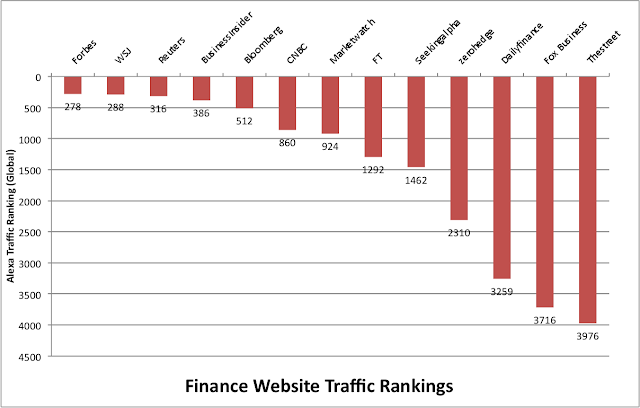

Finance Website Web Traffic Comparison

Below is a comparison of the web traffic rank of some of the most popular finance sites on the web. The list was formulated simply based on websites that came to mind, so it's highly probable that I missed some high traffic sites in here somewhere. CNN money, yahoo finance and google finance are also three big finance sites that would make the list which can't be extracted from their larger parent sites.

For all the fragmentation of news that the web has caused, the big guys still get the most traffic. Business insider is the lone new-media entrant which has competitive traffic numbers to Forbes, etc. The only true blog that makes this list is zerohedge. The average big name finance blog has a rank between 20,000 and 200,000.

For all the fragmentation of news that the web has caused, the big guys still get the most traffic. Business insider is the lone new-media entrant which has competitive traffic numbers to Forbes, etc. The only true blog that makes this list is zerohedge. The average big name finance blog has a rank between 20,000 and 200,000.

|

Thursday, February 7, 2013

Monetary Base Breaks Out

Data released by the Fed today confirmed that the Monetary Base has officially risen above the range that it had settled in since July of 2011. Since roughly the same time period brent crude oil and gold have also been stuck in a prolonged sideways move, although in recent weeks crude has also begun to turn higher along with the base.

Subscribe to:

Posts (Atom)