If you had $525B, which would you rather own: AAPL or the nation's 6 largest financial institutions? If you sum the market cap of WFC, JPM, C, BAC, GS and MS the number comes out to about the same level as AAPL by itself. If you owned those 6 banks, you would control $4 Trillion in deposits or about half of all US bank deposits. You would also control about $10 Trillion in assets--equal to 2/3 of US GDP.

Thursday, May 31, 2012

US vs. Japan Interest Rates

An all time low on 10 year US interest rates still looks like a nice spread vs. JGB's. Japanese government bonds sport a yield less than 1%. The spread between the US 10 year and Japanese 10 year is the lowest it's been since 1990.

Turning Japanese, I think we're turning Japanese I really think so...

S&P 500 YTD Performance vs. Treasuries

Now that the 10 year yield is below 1.6% and the S&P 500 is down 100 points from its ytd highs, the long bond ETF (TLT) is outperforming the S&P 500 for the year. You may recall that last year TLT was up almost 30%.

Price of Oil in Euros

Because Oil is a commodity that is typically priced in dollars, Americans have benefitted from a declining price of crude in recent weeks as the dollar has risen against the Euro. WTI crude especially (which is the most frequently quoted price of crude in the US) has fallen below 90.

On the flip side, the Europeans have been hit by a double whammy when it comes to crude prices. Not only has Brent (a more appropriate European price proxy) traded at a significant spread to WTI, but also the weakening Euro has meant that Europeans need to pay more for a barrel of oil. In fact, the price of oil hit an all time high in March in Euro terms and has fallen by less than it has in the US in recent weeks. WTI priced in dollars is down by 16.5% while Brent priced in Euros is only down 11%.

On the flip side, the Europeans have been hit by a double whammy when it comes to crude prices. Not only has Brent (a more appropriate European price proxy) traded at a significant spread to WTI, but also the weakening Euro has meant that Europeans need to pay more for a barrel of oil. In fact, the price of oil hit an all time high in March in Euro terms and has fallen by less than it has in the US in recent weeks. WTI priced in dollars is down by 16.5% while Brent priced in Euros is only down 11%.

Wednesday, May 30, 2012

How Do Global Oil Inventories Compare to the US?

One of the factors that is contributing to weak oil prices is that US oil inventories are tracking well above their long term average levels. Global oil inventories are not quite as high as they are in the US though according to data from the International Energy Agency. The data is from a May report that tracks the data through March. Since then US oil inventories have continued to climb, so it's reasonable to assume that the global inventories have risen at least somewhat.

Tuesday, May 29, 2012

Excerpt From "The Second Crash" 1973

I'm currently reading a book written in 1973 by Charles Ellis called The Second Crash which is a semi-fictional account of the aftermath of a 1970 stock market crash. What's amazing about the book is that for everything you might think would have changed since 1973, much of the language resonates just as strongly today. Below is a great passage about the culture on Wall Street. The speaker is a fictional fortune 500 executive:

"What a bunch of jerks those guys are. The only thing that counts in Wall Street is money. Money, money, money, money. There's no reality in that business--everything is for sale. And for sale all day long. Maybe you can't really blame them for losing touch. I mean if you think you can buy and sell General Motors any time of any day--and that's exactly what they think they're doing when they trade a few blocks of GM stock--maybe you learn to have a case of Megalomania. Maybe you just can't help it. Or maybe you have to con yourself so you can live with the fact that you're getting rich doing damned near nothing. Does anybody really believe that trading stocks back and forth really matters all that much?

Every time I go to Vegas I think of Wall Street. They're almost exactly the same. Think about it. Big money is on the line all the time. The action is continuous. The little guy comes in for thrills which the fat cats provide him because they need to finance their overhead. But the real action happens out in the back rooms where it's quiet and everybody plays table stakes. Out front in the casino they've got croupiers and dealers who are just like brokers in a classy boardroom. The noise is even the same--the slots sound just like the automated quote boards and there's that constant hum of people parting with their money. The words are so much alike you have to look carefully to be sure you know where you are--"double up," "let winners run," "you're covered," "I'm short," "I'm hot," and all that. But in both places the only way to really understand what's going on and why is by getting to know the principals. Both groups are interesting. Both groups are good at the same thing. They're good killers."

Bankia Balance Sheet

Bankia currently finds itself at the center of the Eurozone firestorm as the top bailout candidate in Spain. Below are some important metrics for the bank from the most recent (english) financial statements posted on its website. While the NPA ratio is quite high at 7%, what's interesting about Bankia is that compared to many European banks, its tangible equity ratio is actually quite high at above 5%. Most European banks rely on lower risk weighted assets to achieve high tier 1 ratios. Bankia also seems to be more substantially deposit funded than many of its larger European peers, which is generally a positive attribute.

Monday, May 28, 2012

Double Dip No More?

While the S&P 500 continues to trade like 2012 is a repeat of 2011 and 2010, a subtle difference can be gleaned from google search data. On google, there's less interest in recession, and specifically fewer searches and news references of "double dip." Have we finally gotten far enough away from 2009 that people wouldn't classify a hypothetical recession as a double dip?

Euroization and Greece

As talk of a Greek exit from the Euro continues to gain steam, it's worth noting that it's not so easy to force a country to stop using a currency. There are many examples of "dollarized" economies, countries that adopt a foreign currency as legal tender. In fact there are six countries in Europe that are not EU members that use the currency as a primary unit of account. While four of these countries have formal agreements to do so, two do not yet continue to use the Euro. From Wikipedia:

To complicate the picture a little more, international economic relationships in Europe don't start and stop with the EU and the Eurozone. For a look at the landscape, a diagram is below:The euro is also used in countries outside the EU. Three states—Monaco, San Marino, and Vatican City—[15][16] have signed formal agreements with the EU to use the euro and mint their own coins. Nevertheless, they are not considered part of the eurozone by the ECB and do not have a seat in the ECB or Euro Group. Andorra reached a monetary agreement with the EU in June 2011 which will allow it to use the euro as its official currency when ratified. Under the agreement it is intended that Andorra should gain the right to mint its own euro coins as of 1 July 2013, provided that Andorra implements relevant EU legislation.[17]Some states (viz. Kosovo,[note 7] and Montenegro) officially adopted the euro as their sole currency without an agreement and, therefore, have no issuing rights. These states are not considered part of the eurozone by the ECB. However, in some usage, the term eurozone is applied to all territories that have adopted the euro as their sole currency.[18][19][20] Further unilateral adoption of the euro (euroisation), by both non-euro EU and non-EU members, is opposed by the ECB and EU.[21]

Friday, May 25, 2012

Deja Vu All Over Again

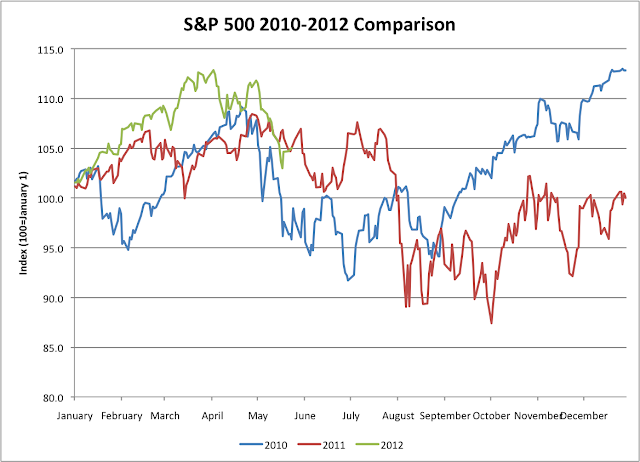

A little under halfway through the year, many are talking about the fact that 2012 is starting to look a lot like 2011 and 2010. For a look at just how closely we're tracking the last two years, below are the annual charts of 2010-2012 plotted on the same chart. The graph is indexed so that January 1=100 for better comparability.

Thursday, May 24, 2012

Comparison of ECB and Fed Balance Sheets

Many Keynesian Monetarists would likely argue that a primary reason that the US economy is faring better than Europe's is that the ECB stayed tighter for longer than the Fed. Empirically, it's tough to argue with such thinking. Now that the ECB has undergone two separate LTRO operations though, the ECB's balance sheet has quickly caught back up to the size of the Fed's.

For now the expansion has had a limited effect on the European economy, but it may have had a greater effect on the currency than most are noticing. The increase in the size of the ECB's balance sheet may be an alternative explanation for the recent struggles of the Euro vs. the Dollar. The chart below compares the relative size of the Fed's balance sheet and the ECB's. It shows that since 2009 major trading patterns in the Euro have tracked the relative expansion of the ECB's balance sheet relative to the US. In times that the Fed's balance sheet expanded faster than the ECB's (the red line moves higher) The Euro strengthened relative to the dollar. In the past five months the ECB's balance sheet has grown much faster than the Fed's and the Euro has weakened. Of course, prior to 2009 this relationship moved in the opposite direction, but prior to then the monetary environment was a little more stable than it is today.

For now the expansion has had a limited effect on the European economy, but it may have had a greater effect on the currency than most are noticing. The increase in the size of the ECB's balance sheet may be an alternative explanation for the recent struggles of the Euro vs. the Dollar. The chart below compares the relative size of the Fed's balance sheet and the ECB's. It shows that since 2009 major trading patterns in the Euro have tracked the relative expansion of the ECB's balance sheet relative to the US. In times that the Fed's balance sheet expanded faster than the ECB's (the red line moves higher) The Euro strengthened relative to the dollar. In the past five months the ECB's balance sheet has grown much faster than the Fed's and the Euro has weakened. Of course, prior to 2009 this relationship moved in the opposite direction, but prior to then the monetary environment was a little more stable than it is today.

Wednesday, May 23, 2012

How Many Companies are There in the US?

There are ~6 million companies operating in the United States employing 114 million people. The average company therefore employs about 20 people.

US vs. Eurozone GDP Per Capita Comparison

Below is a comparison of GDP per capita growth and levels in a selection of European countries vs. the US and Japan. It's probably surprising to most that Spain has grown GDP per capita faster than the 6 other countries in this sample since 1980. It's probably even more surprising that Japan has grown this metric (which is a more accurate measurement of individual well being than aggregate GDP) faster than the US or Germany.

Monday, May 21, 2012

Average Number of News Conferences by Presidency

There was a comment on CNBC this morning about a "rare" press conference being held by president Obama, which sparked this post. Below is a chart of the average number of press conferences held per year by 20th century presidents. GW Bush was often criticized for not holding enough press conferences but compared to Nixon and Reagan he was ubiquitous. Compared to Coolidge, Hoover and Roosevelt though he was less than accessible. Obama has held press conferences with roughly the same frequency as Bush, although Obama supporters may point out that more of Obama's press conferences have been solo rather than tandem with another political leader. Either way, there's not necessarily a correlation between quantity and quality. It's safe to assume there is a high amount of fluff in any presidential press conference.

S&P 500 Performance Q2 after Top Q1s

It may seem like a distant memory by now, but you may recall that 1Q12 was one of the best quarters of all time for the S&P 500. While Q2 has started off on bad footing, there is still a little over a month left for the index to recover. In fact, if the quarter closed now, it would be somewhat anomalous as a 2Q followup to a great Q1. The most the index fell in Q2 after a double digit Q1 was 1.1%. Currently we are down 6.8%.

2006 vs. 2012 Updated

So far this year I've had a couple of posts comparing 2012 to 2006. In January, I mentioned that 2009-2011 had unfolded in a very similar pattern to 2003-2005. Then again in April I mentioned that if this relationship were going to maintain itself then we would have to have a steep correction on the S&P. Well, correct we have, and so here's an updated version of the 2006 vs. 2012 chart.

It may be coincidence or it may be a manifestation of an economic cycle, but either way it seems noteworthy that the 2003-2005 pattern continues to match the pattern of this bull market so closely. We find ourselves basically at the exact same level at the exact same time of year as we did in 2006.

It may be coincidence or it may be a manifestation of an economic cycle, but either way it seems noteworthy that the 2003-2005 pattern continues to match the pattern of this bull market so closely. We find ourselves basically at the exact same level at the exact same time of year as we did in 2006.

How the Best and Worst Stocks of 2011 are Faring in 2012

While last week's alphabet post was tongue in cheek, below is a chart of the year's S&P 500 grouped by a factor that is slightly more relevant to forward returns. The chart compares the 2012 performance of the best and worst performing stocks of last year. It is broken down by quintile; 1 represents 2011's worst performers, while 5 is the group of best performing stocks. The chart shows that so far the winners keep on winning in 2012. The best stocks of 2011 continue to outperform the index in 2012.

Friday, May 18, 2012

S&P 500 Performance by Letter of the Alphabet

Since it's Friday, here's an offbeat post for the day. Below is the YTD performance of equal weighted portfolios consisting of stocks that begin with a given letter. Looks like the T portfolio has been the big winner so far this year, outperforming the S&P 500 by almost 4%. The J portfolio, powered by JNPR, JPM, JCP and JEC has gotten crushed though, down by 8% this year.

Intrade Obama Contract Volume

Intrade has become a popular source as a prediction engine for setting the odds of a future event happening. The total volume traded in the site's most popular contract (the Obama-chances-of-being-reelected contract) is still pretty minimal though. Since December of 2010, there has been a total of $1.4m exchanged in this contract or ~$2,600 per day. Even in the OTC market, there are very few stocks that have such low volume.

Thursday, May 17, 2012

Worst Performance in May for S&P 500

As of this moment, the S&P 500 is on pace to post its 3rd worst performance in May since 1957. Of course, there are still 10.5 trading days left this month. Below is a list of the 10 worst months of May for the S&P 500 since 1957.

Worst Performance in May for S&P 500

Wednesday, May 16, 2012

Brent-WTI Spread

Commodities have taken a beating for the last couple months, which has accelerated since the start of May. Oil, quoted as WTI, has cratered from a high of $107 per barrel to a low of just under $92 as of yesterday. Since the beginning of May, Brent has done a little better than WTI though and so the spread between the two has increased from $13 back to $17 per barrel.

For some perspective, a long term chart of the spread between WTI and Brent is below. Between this spread and the spread of crude to natural gas, there are some historic anomalies occurring in energy markets currently.

Greek Deposit Losses

US equity markets were rattled yesterday when a report came out that Greek banks had lost 700m euros worth of deposits on Monday. It's a large sum in a single day, but it's mostly a continuation of a process that has been in the works for some time. NBG, which is the largest private bank in Greece, has seen its deposits decline by 11.5 billion Euros since 2009. That's 16% of its deposit balances.

Housing Starts

Housing starts were reported this morning at 717k for April on an annualized basis. It's still an extremely low level, but for the first time in a long time, it looks like starts could be breaking out of the low level that they have been stuck in since 09.

Tuesday, May 15, 2012

Top 5 Holdings of Each SPDR ETF

Many investors will use the SPDR ETFs to gain broad exposure to a particular sector, but often they don't give as much thought to the underlying components of each ETF. Below is a list of the top 5 holdings of each SPDR sector ETF. In many cases the top 5 holdings can represent a huge portion of the ETF. The XLY for instance holds 30% of its portfolio in its top 5 holdings, even though it claims 80 total holdings. The bottom 5 holdings of the XLY have a combined weight of 0.77%.

MNST Regulatory Disclosure in 10-k

This caught my eye as something MNST drinkers might be interested in:

We are also subject to Proposition 65 in California, a law which requires that a specific warning appear on any product sold in California that contains a substance listed by that state as having been found to cause cancer or birth defects in excess of certain levels. If we were required to add warning labels to any of our products or place warnings in certain locations where our products are sold, it is difficult to predict whether, or to what extent, such a warning would have an impact on sales of our products in those locations or elsewhere. While none of our beverage products are currently required to display warnings under this law, we cannot predict whether a component of any of our products might be included in the future.Are they trying to say that their drinks may cause cancer or birth defects?

Eurozone Q1 GDPs

Eurozone GDP in Q1 was reported as flat y/y, which was better than expectations. Below is the list of GDPs of component countries. Greece GDP is lower by 6% y/y, while Portugal is 2.2% lower and Spain is only down by 0.4%. For comparison the most that US GDP was down y/y in the financial crisis was ~5%.

Monday, May 14, 2012

Percentage of Days that the S&P is Positive

The S&P 500 has closed lower in 8 of the last 11 trading days. In the 2nd quarter, the S&P has only closed positive 40% of the time, which is quite a losing streak compared to the 1st quarter when the index was higher on 63% of trading days. Since 1957, the S&P has closed higher on just over 52% of days. The skew between the first part of the year and the last month and a half has brought the full year closer to the long term average. For all of 2012, 55% of days have been positive.

Government Securities as Percentage of Banks' Securities Portfolios

As liquidity continues to pool in the US banking system, the securities portfolios of US banks have gotten larger and larger. This phenomenon coupled with the low yield environment is likely at least part of the reason that JPM was "hedging" by buying corporate credit synthetically through the sale of CDS on the investment grade credit index. Even though JPM was playing around with assets with credit risk, the percentage of securities held in government and agency bonds continues to rise. As shown below, since 2009 the percentage of Govies and Agencies in commercial bank securities portfolios has increased to 69% from 52%.

Interestingly, the banking system has started to push more of its portfolio into MBS rather than treasuries. The number of non-MBS government securities as a percentage of the securities portfolio has fallen slightly from 22% to 18% since 2010. (The Fed has only tracked this data since 2009)

Best Performing S&P 500 Stocks Since May 1

Of the stocks that make up the S&P 500, just 85 are positive since May 1. Below are the top 10 performers so far this month.

China Reserve Ratio Chart

It hasn't had much effect on global equity markets today, but China did decide to ease monetary conditions on Saturday by lowering the reserve requirement on large banks. The cut, which will be effective on Friday of this week will drop the requirement back to 20%, which is still quite high by international standards. Below is a chart showing the ratio since 07.

Gold Now Negative For 2012

Now down 1.3% today, gold has turned slightly negative for the year. The GLD is down 0.19% while the S&P 500 is still up more than 7%.

Friday, May 11, 2012

JPM Historical Net Charge Offs

People seem to be appalled that JPM could have assumed a "massive" $2B loss in its $320B trading portfolio in one quarter. In the context of the amount that the bank has charged off in its $720B loan portfolio over the last dozen quarters, $2B is nothing though. In 1Q10 alone, for example, the bank charged off $8B, or 4.5% of the whole portfolio (annualized). No one seems to talk about how risky a bank's loan portfolio is though...

The biggest difference between a bank's loan portfolio and its securities portfolio is that the securities portfolio is marked to market. Being a bank is risky business, period.

The biggest difference between a bank's loan portfolio and its securities portfolio is that the securities portfolio is marked to market. Being a bank is risky business, period.

CIO disclosure in JPM 10Q

Below is an excerpt from JPM's most recent 10-q where it discloses its losses in the CIO unit:

Since March 31, 2012, CIO has had significant mark-to-market losses in its synthetic credit portfolio, and this portfolio has proven to be riskier, more volatile and less effective as an economic hedge than the Firm previously believed. The losses in CIO's synthetic credit portfolio have been partially offset by realized gains from sales, predominantly of credit-related positions, in CIO's AFS securities portfolio. As of March 31, 2012, the value of CIO's total AFS securities portfolio exceeded its cost by approximately $8 billion. Since then, this portfolio (inclusive of the realized gains in the second quarter to date) has appreciated in value

The Firm is currently repositioning CIO's synthetic credit portfolio, which it is doing in conjunction with its assessment of the Firm's overall credit exposure. As this repositioning is being effected in a manner designed to maximize economic value, CIO may hold certain of its current synthetic credit positions for the longer term.

Accordingly, net income in Corporate likely will be more volatile in future periods than it has been in the past.

Worldwide PC Market Share and Size

Global PC shipments grew 1.9% from 1Q11 to 1Q12 in terms of units. Almost 89m PCs were shipped in 1Q12. On a worldwide basis, Apple isn't even a top 5 PC company. In the US it does have 10.6% share though as it shipped 1.6m PCs to its home market.

Thursday, May 10, 2012

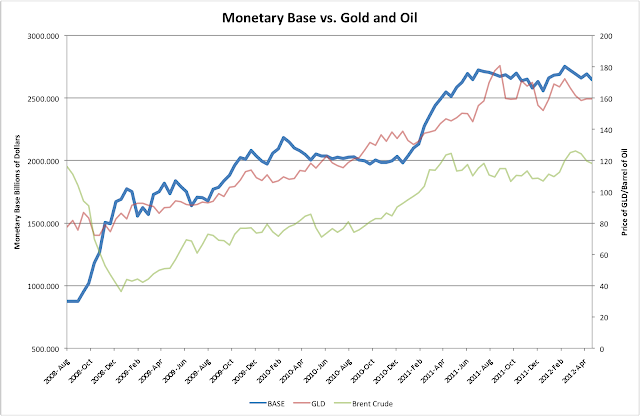

Gold, Oil and the Monetary Base

It's uncanny how closely the week to week trading patters of Gold and Oil have tracked the rise and fall of the US Monetary Base. Since late '08 when the Fed began QE Gold and Oil have seemed to rise and fall with the Monetary Base. For oil especially, note the coincidence of short term peaks and consolidations which seem to lag the movement of the monetary base just slightly. This seems to me to be pretty compelling evidence that monetary policy has been the primary driver of commodity prices.

Chapter 61. Stubb Kills a Whale

JPM, is down 6% in the after market after disclosing that its CIO unit has recorded a $2B loss related to writing CDS on corporate credit. The CIO had recently been chronicled in the Journal and its head executive dubbed the London Whale--as if a passage straight from Moby Dick. Alas, the London whale seems to have met his end:

CHAPTER 61. Stubb Kills a Whale.

...The next day was exceedingly still and sultry, and with nothing special to engage them, the Pequod's crew could hardly resist the spell of sleep induced by such a vacant sea. For this part of the Indian Ocean through which we then were voyaging is not what whalemen call a lively ground; that is, it affords fewer glimpses of porpoises, dolphins, flying-fish, and other vivacious denizens of more stirring waters, than those off the Rio de la Plata, or the in-shore ground off Peru.

It was my turn to stand at the foremast-head; and with my shoulders leaning against the slackened royal shrouds, to and fro I idly swayed in what seemed an enchanted air. No resolution could withstand it; in that dreamy mood losing all consciousness, at last my soul went out of my body; though my body still continued to sway as a pendulum will, long after the power which first moved it is withdrawn.

Ere forgetfulness altogether came over me, I had noticed that the seamen at the main and mizzen-mast-heads were already drowsy. So that at last all three of us lifelessly swung from the spars, and for every swing that we made there was a nod from below from the slumbering helmsman. The waves, too, nodded their indolent crests; and across the wide trance of the sea, east nodded to west, and the sun over all.

Suddenly bubbles seemed bursting beneath my closed eyes; like vices my hands grasped the shrouds; some invisible, gracious agency preserved me; with a shock I came back to life. And lo! close under our lee, not forty fathoms off, a gigantic Sperm Whale lay rolling in the water like the capsized hull of a frigate, his broad, glossy back, of an Ethiopian hue, glistening in the sun's rays like a mirror. But lazily undulating in the trough of the sea, and ever and anon tranquilly spouting his vapoury jet, the whale looked like a portly burgher smoking his pipe of a warm afternoon. But that pipe, poor whale, was thy last. As if struck by some enchanter's wand, the sleepy ship and every sleeper in it all at once started into wakefulness; and more than a score of voices from all parts of the vessel, simultaneously with the three notes from aloft, shouted forth the accustomed cry, as the great fish slowly and regularly spouted the sparkling brine into the air.

"Clear away the boats! Luff!" cried Ahab. And obeying his own order, he dashed the helm down before the helmsman could handle the spokes.

The sudden exclamations of the crew must have alarmed the whale; and ere the boats were down, majestically turning, he swam away to the leeward, but with such a steady tranquillity, and making so few ripples as he swam, that thinking after all he might not as yet be alarmed, Ahab gave orders that not an oar should be used, and no man must speak but in whispers. So seated like Ontario Indians on the gunwales of the boats, we swiftly but silently paddled along; the calm not admitting of the noiseless sails being set. Presently, as we thus glided in chase, the monster perpendicularly flitted his tail forty feet into the air, and then sank out of sight like a tower swallowed up.

"There go flukes!" was the cry, an announcement immediately followed by Stubb's producing his match and igniting his pipe, for now a respite was granted. After the full interval of his sounding had elapsed, the whale rose again, and being now in advance of the smoker's boat, and much nearer to it than to any of the others, Stubb counted upon the honour of the capture. It was obvious, now, that the whale had at length become aware of his pursuers. All silence of cautiousness was therefore no longer of use. Paddles were dropped, and oars came loudly into play. And still puffing at his pipe, Stubb cheered on his crew to the assault.

Yes, a mighty change had come over the fish. All alive to his jeopardy, he was going "head out"; that part obliquely projecting from the mad yeast which he brewed.*

*It will be seen in some other place of what a very light substance the entire interior of the sperm whale's enormous head consists. Though apparently the most massive, it is by far the most buoyant part about him. So that with ease he elevates it in the air, and invariably does so when going at his utmost speed. Besides, such is the breadth of the upper part of the front of his head, and such the tapering cut-water formation of the lower part, that by obliquely elevating his head, he thereby may be said to transform himself from a bluff-bowed sluggish galliot into a sharppointed New York pilot-boat.

"Start her, start her, my men! Don't hurry yourselves; take plenty of time—but start her; start her like thunder-claps, that's all," cried Stubb, spluttering out the smoke as he spoke. "Start her, now; give 'em the long and strong stroke, Tashtego. Start her, Tash, my boy—start her, all; but keep cool, keep cool—cucumbers is the word—easy, easy—only start her like grim death and grinning devils, and raise the buried dead perpendicular out of their graves, boys—that's all. Start her!"

"Woo-hoo! Wa-hee!" screamed the Gay-Header in reply, raising some old war-whoop to the skies; as every oarsman in the strained boat involuntarily bounced forward with the one tremendous leading stroke which the eager Indian gave.

But his wild screams were answered by others quite as wild. "Kee-hee! Kee-hee!" yelled Daggoo, straining forwards and backwards on his seat, like a pacing tiger in his cage.

"Ka-la! Koo-loo!" howled Queequeg, as if smacking his lips over a mouthful of Grenadier's steak. And thus with oars and yells the keels cut the sea. Meanwhile, Stubb retaining his place in the van, still encouraged his men to the onset, all the while puffing the smoke from his mouth. Like desperadoes they tugged and they strained, till the welcome cry was heard—"Stand up, Tashtego!—give it to him!" The harpoon was hurled. "Stern all!" The oarsmen backed water; the same moment something went hot and hissing along every one of their wrists. It was the magical line. An instant before, Stubb had swiftly caught two additional turns with it round the loggerhead, whence, by reason of its increased rapid circlings, a hempen blue smoke now jetted up and mingled with the steady fumes from his pipe. As the line passed round and round the loggerhead; so also, just before reaching that point, it blisteringly passed through and through both of Stubb's hands, from which the hand-cloths, or squares of quilted canvas sometimes worn at these times, had accidentally dropped. It was like holding an enemy's sharp two-edged sword by the blade, and that enemy all the time striving to wrest it out of your clutch.

"Wet the line! wet the line!" cried Stubb to the tub oarsman (him seated by the tub) who, snatching off his hat, dashed sea-water into it.* More turns were taken, so that the line began holding its place. The boat now flew through the boiling water like a shark all fins. Stubb and Tashtego here changed places—stem for stern—a staggering business truly in that rocking commotion.

*Partly to show the indispensableness of this act, it may here be stated, that, in the old Dutch fishery, a mop was used to dash the running line with water; in many other ships, a wooden piggin, or bailer, is set apart for that purpose. Your hat, however, is the most convenient.

From the vibrating line extending the entire length of the upper part of the boat, and from its now being more tight than a harpstring, you would have thought the craft had two keels—one cleaving the water, the other the air—as the boat churned on through both opposing elements at once. A continual cascade played at the bows; a ceaseless whirling eddy in her wake; and, at the slightest motion from within, even but of a little finger, the vibrating, cracking craft canted over her spasmodic gunwale into the sea. Thus they rushed; each man with might and main clinging to his seat, to prevent being tossed to the foam; and the tall form of Tashtego at the steering oar crouching almost double, in order to bring down his centre of gravity. Whole Atlantics and Pacifics seemed passed as they shot on their way, till at length the whale somewhat slackened his flight.

"Haul in—haul in!" cried Stubb to the bowsman! and, facing round towards the whale, all hands began pulling the boat up to him, while yet the boat was being towed on. Soon ranging up by his flank, Stubb, firmly planting his knee in the clumsy cleat, darted dart after dart into the flying fish; at the word of command, the boat alternately sterning out of the way of the whale's horrible wallow, and then ranging up for another fling.

The red tide now poured from all sides of the monster like brooks down a hill. His tormented body rolled not in brine but in blood, which bubbled and seethed for furlongs behind in their wake. The slanting sun playing upon this crimson pond in the sea, sent back its reflection into every face, so that they all glowed to each other like red men. And all the while, jet after jet of white smoke was agonizingly shot from the spiracle of the whale, and vehement puff after puff from the mouth of the excited headsman; as at every dart, hauling in upon his crooked lance (by the line attached to it), Stubb straightened it again and again, by a few rapid blows against the gunwale, then again and again sent it into the whale.

"Pull up—pull up!" he now cried to the bowsman, as the waning whale relaxed in his wrath. "Pull up!—close to!" and the boat ranged along the fish's flank. When reaching far over the bow, Stubb slowly churned his long sharp lance into the fish, and kept it there, carefully churning and churning, as if cautiously seeking to feel after some gold watch that the whale might have swallowed, and which he was fearful of breaking ere he could hook it out. But that gold watch he sought was the innermost life of the fish. And now it is struck; for, starting from his trance into that unspeakable thing called his "flurry," the monster horribly wallowed in his blood, overwrapped himself in impenetrable, mad, boiling spray, so that the imperilled craft, instantly dropping astern, had much ado blindly to struggle out from that phrensied twilight into the clear air of the day.

And now abating in his flurry, the whale once more rolled out into view; surging from side to side; spasmodically dilating and contracting his spout-hole, with sharp, cracking, agonized respirations. At last, gush after gush of clotted red gore, as if it had been the purple lees of red wine, shot into the frighted air; and falling back again, ran dripping down his motionless flanks into the sea. His heart had burst!

"He's dead, Mr. Stubb," said Daggoo.

"Yes; both pipes smoked out!" and withdrawing his own from his mouth, Stubb scattered the dead ashes over the water; and, for a moment, stood thoughtfully eyeing the vast corpse he had made.

Wednesday, May 9, 2012

Brave New World With Stephen Hawking

I highly recommend this series that's airing on the Science channel for anyone who wants a reason to feel optimistic about the future. It highlights emerging technologies--this episode happens to be about machines. The episode highlights Google's self driving car, mind controlled wheel chairs, artificial intelligence and the H.U.L.K. suit developed by Raytheon which allows a person to carry the workload of three men. This type of technology is the stuff that drives real growth, and will eventually make worries about Europe look totally foolish and transitory.

Back of the envelope, Google's self driving car could be worth $2T+ in market cap.

Back of the envelope, Google's self driving car could be worth $2T+ in market cap.

Commercial Hedger Position on Crude

As WTI crude oil prices have fallen recently, commercial hedgers of oil and large traders have divergent views of where the commodity will head next. Commercial hedgers are large net sellers of crude relative to their positioning over the last 5 years, implying a bearish outlook.

Tuesday, May 8, 2012

Eurozone Nominal GDPs

Eurozone CPIs

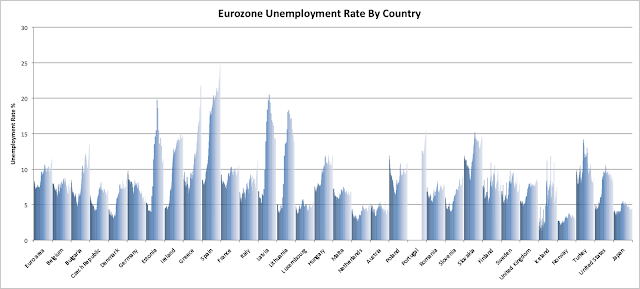

Eurozone Unemployment

5-10% pullback

The lows of today's session approximately coincided with a 5% pullback from the ytd high. While completely arbitrary, people often look for declines in the 5-10% range from a near term top. A 10% decline would take us back to 1280, and erase most of the year's gains. If 2012 ends up looking like 2011 and 2010, this would be the level that one might expect us to get back to.

Number of 1% Decline Days on S&P

UPDATE: Well I guess this post was a little premature. 6 down days it is.

At the end of February, I posted that at that point in 2012, there had still not been a decline of 1% or more in a single day. Fast forward to May 8 and today's decline--we have now had 7 days of 1% decline or greater. Below is a chart comparing the pace that we had 1% decline days in 2011 vs. 2012. In the last month and a half, 2012 has really picked up the pace of high volatility days.

At the end of February, I posted that at that point in 2012, there had still not been a decline of 1% or more in a single day. Fast forward to May 8 and today's decline--we have now had 7 days of 1% decline or greater. Below is a chart comparing the pace that we had 1% decline days in 2011 vs. 2012. In the last month and a half, 2012 has really picked up the pace of high volatility days.

Monday, May 7, 2012

May Investor Letter

Below is a letter that is written monthly for the benefit of Avondale Asset Management's clients. It is reproduced here for informational purposes for the readers of this blog.

Dear Investors,

April was the start of earnings season for the first quarter, which is when public companies report their quarterly results. Earnings season is by far one of the most chaotic times to be an investor because of the sheer volume of data that is being generated by the companies that we follow. It’s a whirlwind of events that lasts for roughly 30 days starting in the second week of April, July, October and January. During this time period a majority of the 5000 publicly traded US companies will issue a press release and hold an hour-long conference call in which management gives a recap of quarterly events and an update on forward outlook. All told, these 5000 companies may generate between three and seven thousand hours worth of data in the span of 720 physical hours. Surrounding the news flow the volatility of individual stocks can become extreme. It’s common that individual stocks will move up or down by double-digit percentage points in one day based on a quarterly miss or beat.

As longer-term investors, we make it a point to not lend too much weight to any single quarter’s results. Still, we operate in a marketplace that is dominated by those who do and therefore our companies will tend to get swept up in the frenzy. In such an environment the most important skill an investor can have is the presence of mind not to make capricious decisions. Decisions made based on half formed opinions can be particularly costly in an environment in which stocks may gain or lose one fifth of their value in a single trading session.

Earnings season is important to long term investors too though. From all this data we gain new insights into the companies that we own, ensure that the reasons that we own them are still valid and also gain insight into the general economy from some terrific management teams.

I wrote last month that I would be watching earnings closely for signs that my initial optimistic forecast for the year needed to be revised even higher. After listening to many companies describe their business and prospects, I am not convinced that it does. In general most companies have reported strong earnings, but not so strong as to justify significantly higher stock prices for the time being. Most companies seem to be reporting that the US is healthy, but that China is slowing and Europe is in recession. While it’s remarkable to see the US leading the global economy, it’s troublesome that two of the three largest global markets are showing signs of weakness. If our own recovery is expected to continue, either Europe or China will have to keep pace. I’m am skeptical that the US can detach from the rest of the world, especially considering that our economy continues to receive a large amount of stimulus in the form of large budget deficits and low interest rates. Looking further out, I am concerned that the European situation is a model for what could happen when stimulus is removed from our economy. In particular, England, which shares many attributes with our economy, entered a recession last quarter partially thanks to budget cuts.

In April, these concerns started to affect US equity prices. The S&P 500 fell 0.75% and was down as much as 3.5% at mid month. While our portfolios were not immune to this pullback, we do have extra cash to capitalize on it, and the good news is that global economic uncertainty has already brought the price of many desirable companies to levels that are attractive for our portfolios. I have been opportunistically beginning to purchase more shares of these companies in April and May. However, I am still conscious of adding too much general exposure to the market until I see a more broad-based selloff. I feel that patience is still key.

Scott Krisiloff, CFA

Opinions voiced in the letter should not be viewed as a recommendation of any specific investment. Past performance is not a guarantee or reliable indicator of future results. Investing is subject to risk including loss of principal. Investors should consider the suitability of any investment strategy within the context of their personal portfolio. For more information on Avondale Asset Management, readers may be directed here.

Dear Investors,

April was the start of earnings season for the first quarter, which is when public companies report their quarterly results. Earnings season is by far one of the most chaotic times to be an investor because of the sheer volume of data that is being generated by the companies that we follow. It’s a whirlwind of events that lasts for roughly 30 days starting in the second week of April, July, October and January. During this time period a majority of the 5000 publicly traded US companies will issue a press release and hold an hour-long conference call in which management gives a recap of quarterly events and an update on forward outlook. All told, these 5000 companies may generate between three and seven thousand hours worth of data in the span of 720 physical hours. Surrounding the news flow the volatility of individual stocks can become extreme. It’s common that individual stocks will move up or down by double-digit percentage points in one day based on a quarterly miss or beat.

As longer-term investors, we make it a point to not lend too much weight to any single quarter’s results. Still, we operate in a marketplace that is dominated by those who do and therefore our companies will tend to get swept up in the frenzy. In such an environment the most important skill an investor can have is the presence of mind not to make capricious decisions. Decisions made based on half formed opinions can be particularly costly in an environment in which stocks may gain or lose one fifth of their value in a single trading session.

Earnings season is important to long term investors too though. From all this data we gain new insights into the companies that we own, ensure that the reasons that we own them are still valid and also gain insight into the general economy from some terrific management teams.

I wrote last month that I would be watching earnings closely for signs that my initial optimistic forecast for the year needed to be revised even higher. After listening to many companies describe their business and prospects, I am not convinced that it does. In general most companies have reported strong earnings, but not so strong as to justify significantly higher stock prices for the time being. Most companies seem to be reporting that the US is healthy, but that China is slowing and Europe is in recession. While it’s remarkable to see the US leading the global economy, it’s troublesome that two of the three largest global markets are showing signs of weakness. If our own recovery is expected to continue, either Europe or China will have to keep pace. I’m am skeptical that the US can detach from the rest of the world, especially considering that our economy continues to receive a large amount of stimulus in the form of large budget deficits and low interest rates. Looking further out, I am concerned that the European situation is a model for what could happen when stimulus is removed from our economy. In particular, England, which shares many attributes with our economy, entered a recession last quarter partially thanks to budget cuts.

In April, these concerns started to affect US equity prices. The S&P 500 fell 0.75% and was down as much as 3.5% at mid month. While our portfolios were not immune to this pullback, we do have extra cash to capitalize on it, and the good news is that global economic uncertainty has already brought the price of many desirable companies to levels that are attractive for our portfolios. I have been opportunistically beginning to purchase more shares of these companies in April and May. However, I am still conscious of adding too much general exposure to the market until I see a more broad-based selloff. I feel that patience is still key.

Scott Krisiloff, CFA

Opinions voiced in the letter should not be viewed as a recommendation of any specific investment. Past performance is not a guarantee or reliable indicator of future results. Investing is subject to risk including loss of principal. Investors should consider the suitability of any investment strategy within the context of their personal portfolio. For more information on Avondale Asset Management, readers may be directed here.

Friday, May 4, 2012

10 year 30 Year Yield Spread

The yield on the 10 year is now solidly back below 2% at 1.88%. The 30 year bond has maintained a wide spread over the 10 year despite the rally. The spread isn't as wide as it has been at times over the last couple years, but it is still the wider than it's been in any other period.

Thursday, May 3, 2012

Japan Aging Population

For comparison to the previous post about the aging US population, below is a chart forecasting demographic trends for Japan. The 65+ population of Japan is already 23% and forecast to be nearly 40% by 2050. How can anyone expect such an economy to grow, let alone service its massive debt load?

Demographics of Japanese Population

Projection of US Elderly Population

Grocery Store Comparison

Whole Foods is now the largest grocery chain in the US by market value even though it has almost 8x fewer stores than Kroger does, which is its next largest competitor by market cap. Since most of WFM's competitors carry a sizable amount of debt, it's a little more instructive to compare the group on an enterprise value basis. WFM is still only the second largest market chain on this basis.

Subscribe to:

Posts (Atom)