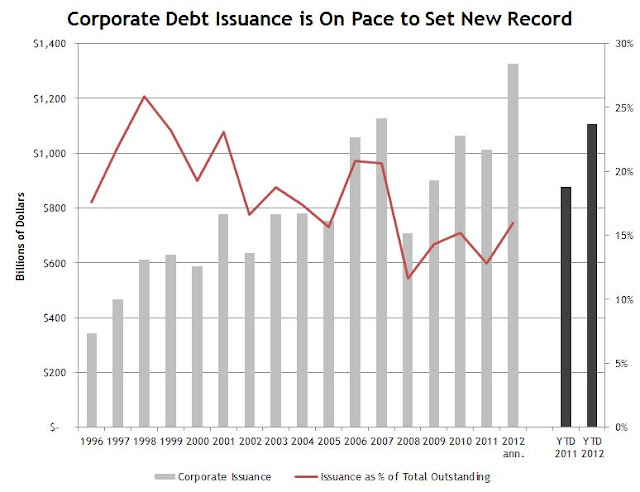

One of the goals of maintaining a zero interest rate environment is to encourage consumers and companies to take actions like this. The Fed is trying to push the economy to re-lever. So far, it has had mixed success in this pursuit, although borrowing has begun to pick back up in 2012.

As far as corporate debt securities go, 2012 could be a strong year. US companies are on pace to issue $1.3T in new debt into securities markets (through October). This would be a new all time high and is already more than was sold in all of 2011. As a percentage of corporate bonds outstanding though, that number is still lower than in the late 90s--only 16% vs over 25% back then. It's almost double what was issued in 2008 when credit markets froze though.

|

| Source: SIFMA |

No comments:

Post a Comment

For compliance reasons, I don't post comments to the site, but I do like hearing from readers and am happy to answer any questions. Feel free to use the comment box to get in touch. Please leave an email address in your comment so that I can write back, or email me directly at Skrisiloff@avondaleam.com.