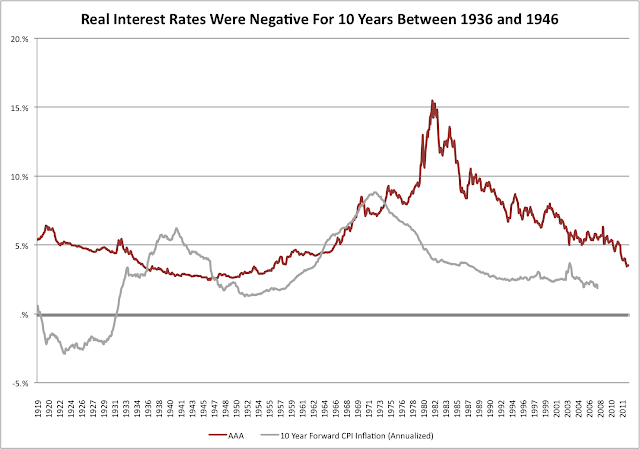

Dalio argued that real rates are currently negative (nominal rate minus inflation)--which they are--but they were also negative for 10 years between 1936 and 1946 as shown by the chart below, which compares Moody's average Aaa bond yield to the realized 10 year forward inflation rate. Inflation was high during this period, reaching above 10% in some years thanks to WWII. The fact that rates stayed low is a testament to the fact that it's not a good decision to try to fight the Fed.

|

| Used Aaa bonds as proxy for risk free rate. Source: Federal Reserve Data |

No comments:

Post a Comment

For compliance reasons, I don't post comments to the site, but I do like hearing from readers and am happy to answer any questions. Feel free to use the comment box to get in touch. Please leave an email address in your comment so that I can write back, or email me directly at Skrisiloff@avondaleam.com.